The 2025 Minimum Wage in Australia

Australia’s minimum wage is a cornerstone of the nation’s labor standards, ensuring fair compensation for workers. For newcomers, understanding the minimum wage, salary expectations, and taxation is crucial for financial planning. This article delves into the 2025 updates and their implications for employees and employers.

2025 Minimum Wage Overview

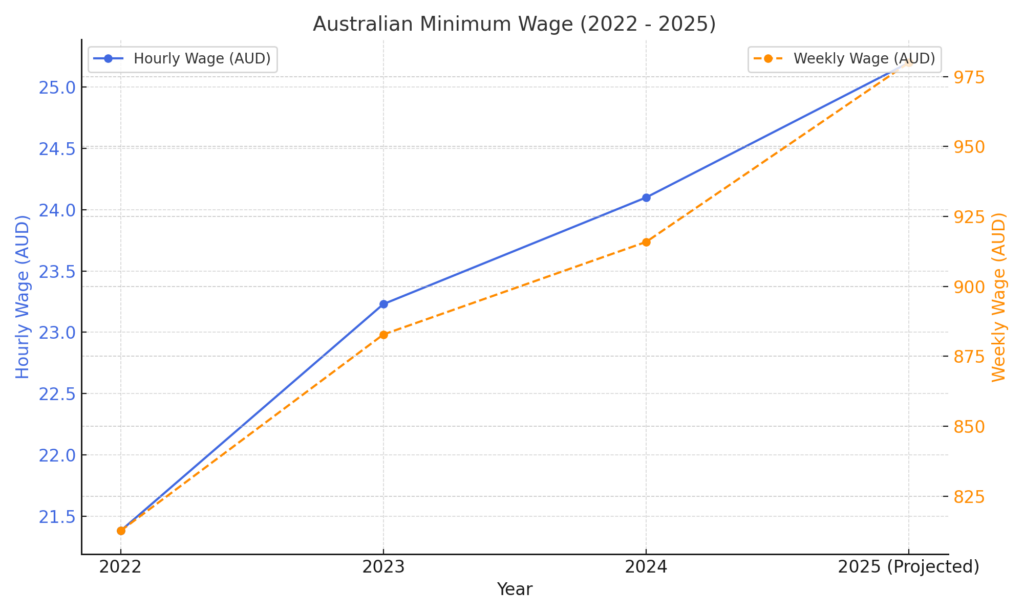

The national minimum wage in Australia as of July 1, 2025, is anticipated to rise following the annual review by the Fair Work Commission. The following figures highlight the current state and projected changes:

- Current Minimum Wage (2024): $24.10 per hour or $915.90 per 38-hour week (before tax).

- Projected Minimum Wage (2025): Estimated to increase to approximately $25.20 per hour or $980.00 per 38-hour week, subject to Fair Work Commission’s final decision.

- Casual Loading: Casual employees receive an additional 25%, bringing their hourly rate to around $31.50 in 2025.

These updates reflect Australia’s commitment to maintaining a fair and sustainable wage system. The ongoing adjustments aim to keep up with inflation and cost-of-living pressures, ensuring workers’ purchasing power remains intact.

People are also interested about the following:

- Minimum Wage for Hospitality & Retail Workers in Australia (2025)

- Apprenticeship & Trainee Wages in Australia (2025 Guide)

- How to Get PR in Australia After Study

- Student Dependent Visa Checklist for 2025 (Spouses and Children)

Minimum Wage & Living Expenses Calculator

Chart comparing Australia’s minimum wage from 2022 to the projected 2025 figures

How 2025 Changes Impact Newcomers

For newcomers, these updates offer a mix of opportunities and challenges:

- Higher Wages: The anticipated increase in minimum wage improves financial stability for entry-level workers.

- Increased Compliance: Stricter regulations ensure fair treatment and pay for all employees.

- Tax Planning: Understanding tax obligations helps newcomers maximize their income and avoid penalties.

- Digital Tools for Workers: More employers are leveraging payroll technology, ensuring transparent and timely wage disbursements, which benefit employees.

10 Highest Paying Jobs in Australia

Australia offers lucrative career opportunities, with several industries providing high salaries for skilled professionals. Whether you’re planning your career path or considering a job change, knowing which occupations offer the highest earnings can be valuable. Below is a list of the top 10 highest-paying jobs in Australia, along with insights into their salaries, required skills, and industry demand.

Surgeon – $400,000 to $600,000 per year

Anaesthetist – $300,000 to $500,000 per year

Psychiatrist – $200,000 to $300,000 per year

Mining Engineer – $150,000 to $250,000 per year

IT Manager – $120,000 to $180,000 per year

Dentist – $150,000 to $200,000 per year

Petroleum Engineer – $180,000 to $250,000 per year

Legal Professional (Lawyer) – $100,000 to $200,000 per year

Engineering Manager – $130,000 to $180,000 per year

Marketing Director – $120,000 to $200,000 per year

> Learn More About Highest Paying Jobs

Future Trends in Australia’s Labor Market

The labor market in Australia is evolving rapidly, with several futuristic trends set to impact employment and wage dynamics:

- Rise of Remote Work: The flexibility of remote work is becoming a standard expectation, with companies offering competitive wages to attract top talent globally.

- Automation and AI Integration: Industries like manufacturing and logistics are increasingly adopting automation, creating demand for tech-savvy workers and reshaping wage structures.

- Sustainability-Driven Jobs: Renewable energy and green infrastructure are driving job creation, with roles in these sectors expected to command above-average wages.

- Gig Economy Expansion: Platforms facilitating gig and freelance work are gaining popularity, offering individuals opportunities to supplement their income while maintaining flexibility.

Best Jobs in Australia Without a Degree

Many Australians and migrants are choosing alternative career paths that don’t require a traditional university education. Here’s why:

- Lower Education Costs: Avoiding student loans and university tuition fees.

- Faster Entry into the Workforce: Start earning sooner without spending years in school.

- High Demand for Skilled Workers: Some industries value hands-on experience and certifications more than degrees.

- Opportunities for Growth: Many non-degree jobs offer career advancement through training and experience.

Here are some high-paying jobs in Australia that do not require a university degree, along with their average annual salary ranges:

- Construction Manager: Approximately AUD 150,000 to AUD 185,000 per year.

- Real Estate Agent: Average salary around AUD 84,928 per year, with potential increases based on commissions.

- Air Traffic Controller: Median salary approximately AUD 95,000 per year.

- Police Officer: Average salary varies based on rank and experience.

- Mining Worker: Salaries can range significantly; some mining operators start at AUD 140,000 per year.

- Senior Electrician: Experienced electricians can earn over AUD 200,000 annually, especially in high-demand areas.

- Commercial Pilot: Salaries vary widely based on experience and employer.

- IT Support Specialist: Average salary varies based on experience and specialization.

Please note that these figures are approximate and can vary based on factors such as experience, location, and specific employer. For the most accurate and up-to-date information, consulting industry reports or job-specific salary surveys is recommended.

> Learn More About Best Jobs in Australia Without A Degree

Legislative Changes Impacting 2025 Minimum Wage

In 2025, several legislative updates will reshape wage policies and employment standards in Australia, aiming to enhance worker protections and ensure fair pay practices.

Criminalization of Wage Theft

The Australian government is taking a firmer stance against wage theft. Employers who deliberately underpay workers or fail to meet legal wage obligations may now face criminal charges. Key penalties include:

- Heavy fines for businesses engaged in systematic underpayment.

- Potential imprisonment for individuals found guilty of intentional wage theft.

- Stronger enforcement by regulatory bodies, such as the Fair Work Ombudsman, with increased audits and compliance checks.

This move underscores the government’s commitment to holding businesses accountable and safeguarding workers’ rights.

Award Modifications and Simplified Pay Structures

To improve wage compliance and simplify employment conditions, significant updates to the Modern Awards System will take effect. These modifications aim to:

- Clarify pay structures by standardizing classifications within awards.

- Ensure fair pay calculations for part-time and casual employees.

- Reduce employer misclassification risks, preventing wage discrepancies due to incorrect award applications.

Key Award Changes for 2025

- Entry-Level Classifications: Revised entry-level roles in select industries, ensuring fair pay rates and reducing confusion around wage brackets.

- Casual and Part-Time Pay Adjustments: Adjustments to award rates to improve transparency in how casual loading and overtime apply.

- Penalty Rate Updates: Some industries, particularly hospitality, retail, and healthcare, may see refinements in penalty rates for evening, weekend, and public holiday work.

- Industry-Specific Amendments: Awards covering aged care, construction, and education will receive tailored updates to reflect evolving workforce needs.

Employees should review the Fair Work Commission’s official award determinations to confirm their correct classification and entitlements.

Increased Focus on Gender Pay Equality

To further address wage disparity, new regulations will enforce greater transparency in gender pay reporting. Employers will be required to:

- Publish pay gap data to highlight discrepancies.

- Implement corrective measures where significant inequalities exist.

- Undergo stricter audits in industries with historically wide gender pay gaps.

These measures are designed to create a more equitable workforce where women receive the same compensation as their male counterparts for equal work.

How Minimum Wage Workers Can Report Underpayment or Wage Theft

Workers who suspect they are being underpaid or experiencing wage theft should take the following steps:

- Check Your Payslip and Employment Contract

- Compare your actual wage with the minimum rates set in your relevant award or agreement.

- Review penalty rates, overtime pay, and casual loading to ensure accuracy.

- Raise the Issue with Your Employer

- In many cases, underpayment can be an oversight. Speak to your employer or HR department to request a review of your wages.

- Seek Advice from the Fair Work Ombudsman

- The Fair Work Ombudsman (FWO) provides free advice and resources for employees. Visit www.fairwork.gov.au or call their hotline to discuss concerns.

- The FWO can also provide wage calculators to help workers determine if they are being paid correctly.

- Lodge a Formal Complaint

- If your employer fails to correct underpayment, you can submit an official complaint through the Fair Work Ombudsman.

- This may trigger an investigation, employer audits, and potential penalties for non-compliance.

- Take Legal Action (If Necessary)

- If other steps fail, workers may take legal action through small claims courts or seek representation from unions or legal aid organizations.

It is crucial for both employers and employees to stay informed about minimum wage laws, awards, and employment rights to avoid legal and financial consequences.

Key Takeaways for Employers and Employees

- Employers must stay up to date with wage laws to avoid penalties and ensure compliance with revised award structures.

- Employees should routinely check their awards, classification levels, and payslips to verify proper pay and entitlements.

- Resources like the Fair Work Ombudsman offer support and guidance for workers facing wage-related issues.

With these legislative changes in effect, staying informed is crucial to navigating Australia’s evolving labor landscape in 2025.

Tips for Navigating the Australian Job Market

- Verify Pay Rates: Use tools like the Fair Work Ombudsman’s Pay Calculator to confirm your hourly rate.

- Track Legislative Updates: Stay informed about wage-related changes to ensure compliance and fair treatment.

- Plan for Taxes: Set aside a portion of your income for tax obligations and consider consulting a tax professional.

- Upskill Continuously: Pursuing additional qualifications can boost your earning potential, especially in high-demand industries like healthcare and IT.

- Explore Emerging Opportunities: Keep an eye on future-oriented industries like clean energy and AI to align your career path with market trends.

The 2025 minimum wage in Australia reflects the nation’s ongoing efforts to support fair labor standards. For newcomers, understanding these changes and preparing accordingly can make a significant difference in their financial stability and success. As the job market evolves, staying informed about legislative updates and emerging trends is crucial. By leveraging available resources and planning proactively, individuals can thrive in Australia’s dynamic workforce.

Understanding Taxation in 2025

Taxation is a critical aspect of financial planning in Australia. Below are key updates for the 2024-2025 fiscal year:

- Income Tax Brackets:

| Income Range (AUD) | Tax Rate |

| $0 – $18,200 | 0% |

| $18,201 – $45,000 | 19% |

| $45,001 – $120,000 | 32.5% |

| $120,001 – $180,000 | 37% |

| $180,001+ | 45% |

- Medicare Levy: A 2% levy applies to most taxpayers, funding the nation’s public healthcare system.

- Medicare Levy Surcharge: High-income earners without private health insurance may incur an additional surcharge of 1% to 1.5%.

- Tax Deductions: Employees are encouraged to explore work-related tax deductions, such as costs for uniforms, tools, and professional development courses.

Start Your Journey Today

Ready to make the move to Australia? At My New Australian Life, we’re here to support you every step of the way. Whether you need assistance understanding wage structures, navigating taxation, or planning your career path, we provide tailored advice and resources to help you succeed.

Visit My New Australian Life to learn more about our services, or contact us today for personalized guidance on settling and thriving in Australia.

For more details on the annual minimum wage review, visit the Fair Work Commission. To calculate your exact pay rates, explore the Fair Work Ombudsman Pay Calculator. For updates on taxation brackets and Medicare Levy changes, refer to the Australian Taxation Office (ATO).